Table of Content

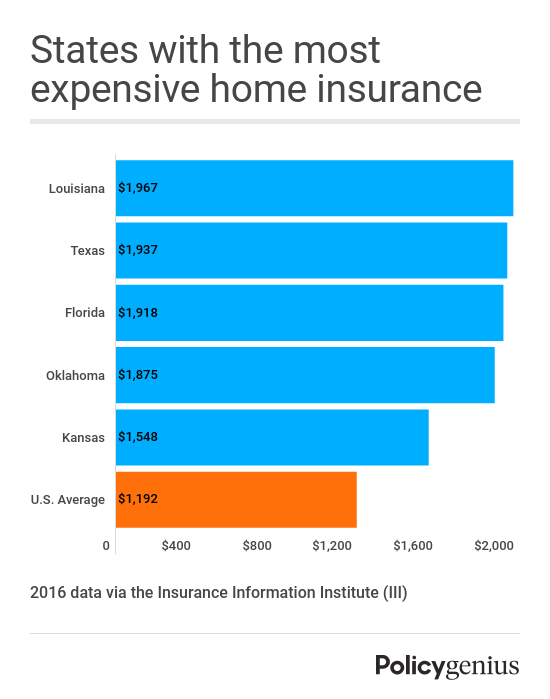

All come with a $1,000 deductible.You can compare average rates for 10 different coverage levels in the table listed below. Get even more information by reading our recommended coverage level guide. Oklahoma remains the most expensive state for homeowners insurance in the United States for another year.

Average insurance rates for renters are about $175 per year for $33,000 to $37,000 of coverage. That’s 15 bucks per month, or roughly three Iced Sugar Cookie Almond Milk Lattes. Ultimately, Nationwide home insurance is the best place to start comparing rates for your policy, but it shouldn't be the only insurer you check. Other large insurers — or even local companies — might offer both a decent rate and solid service. A crowdsourced database with a cost of living calculator for prices comparison in 9294 cities in 197 countries all over the world. Liability insurance pays out when you or a family member are legally responsible for others’ injuries or property damage.

Farm and ranch insurance

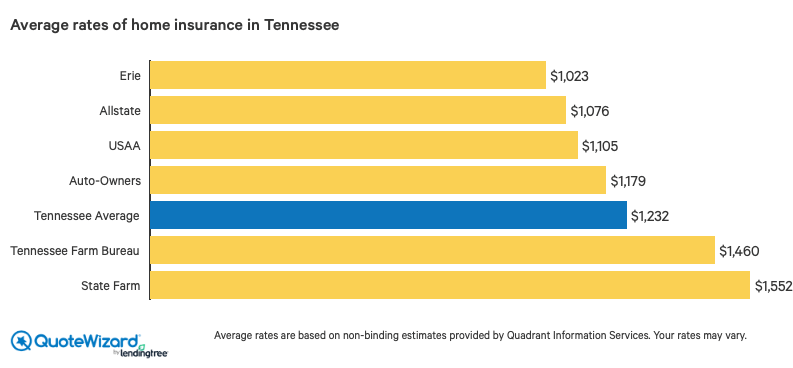

The rates we discovered are best used for comparative purposes — your own quotes from these insurers may be different. Where Erie insurance is available, you may be able to take advantage of even better rates. A policy with Erie costs $883 per year or $74 per month, which is 47% cheaper than the national average.

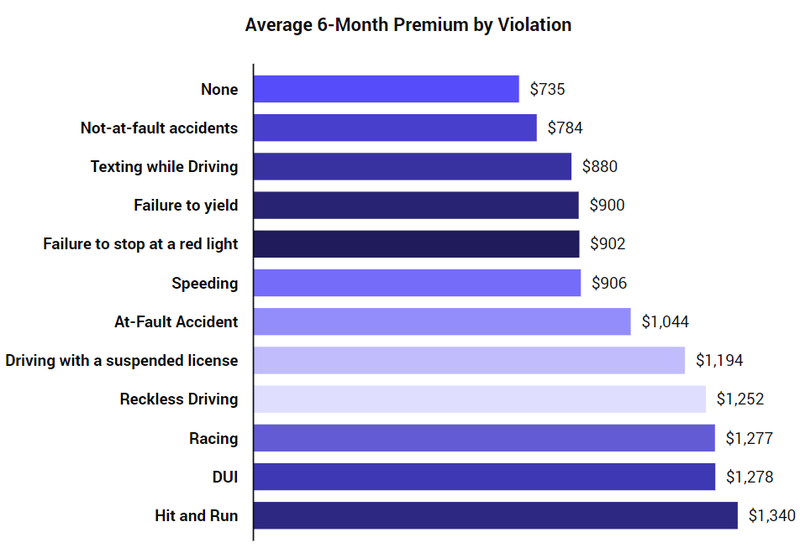

However, if you go beyond this period, then the state can issue you a fine for each day that your vehicle is uninsured. Your personal rate may differ considerably, depending on your age, credit score, driving record, the type of car you're driving, and the city and state you receive coverage in. Depending on your individual needs, State Farm usually provides coverage on a six-month or a twelve-month basis.

Home and property insurance

If you’re interested, head over to our Lorex cost guide; they make some of the best cameras on the market. Since a large part of what you’re protecting with renters insurance is your personal property, you’ll definitely want to explore State Farm’s coverage limits. For instance, if you have a lot of valuables or collectibles, or what would be considered “business property” , you may need to pay extra for full coverage. ValuePenguin's analysis used insurance rate data from Quadrant Information Services.

The average annual rate for a home with $400,000 in dwelling coverage and $300,000 in liability and $1,000 deductible is about $3,231, according to a rate analysis by Insure.com. California is one of the least expensive states for home insurance. The annual home insurance cost of $1,380 is a statewide average and doesn’t include coverage for flooding and earthquakes. Both plans are optional for homeowners and must be purchased separately. But rates vary significantly from state to state and from city to city.

Step 4: Choose a deductible

Insurance.com’s ranking provides an in-depth look at the best home insurance companies in 2022, based on a number of factors. Insurance.com ranked the major insurance companies for average price, J.D. Your dwelling coverage should equal the cost to repair damage to your home or rebuild it completely at equal quality — at current prices. Deductible on any of your insurance policies from State Farm can lower your premium. But if you decide to go this route, it’s important that you choose a deductible amount that you can still afford if you suddenly need to file a claim.

However, Erie isn't available to most homeowners, because the company only operates in 12 states. The exact amount that premiums go up after an accident depends on a few factors, including who was at fault, how much damage was caused, and the policyholder’s driving and claims history. In general, at-fault accidents or severe accidents that lead to expensive insurance claims increase rates more than minor or not-at-fault wrecks.

It’s no secret that homeowners insurance premiums vary greatly depending on your ZIP code. Dr. Marlett suggests homeowners get quotes from multiple companies and ask each insurer to provide a quote based on a $500, $1,000 and $2,500 deductible option. Compare these quotes against each other — and remember to ask about any available discounts. An any driver insurance policy allows anyone to drive your car at any time. There's no limit to how many people can drive the car, so any friends or family, who have your permission, are legally insured to drive it.

After you receive your online homeowners insurance quote, a State Farm agent is available to help you complete the purchase process. You could save up to $1,127 per year if you bundle your State Farm auto and home insurance. We personally saw a 35 percent savings with our bundled quote. State Farm’s rates ($1,308 per year for a basic HO-3 policy) are among the lowest we’ve found this year. That doesn’t mean they’ll be lower than your state’s average, however, which could be anywhere between $700 and $2,600.

State Farm is the largest car insurance company in the United States. Every year, State Farm handles claims for drivers across the United States. The average rate for a house with $200,000 in dwelling coverage is about $2,233 for $300,000 in liability. The NOAA ranks Kansas fourth in the U.S. for major hail events. The Kansas Insurance Department estimated losses of $220,840,165 in 2022 from windstorms, tornados and hail, which contributes to Kansas’ high homeowners insurance rates.

Other endorsements include business property, musical instruments, data recovery, and green improvement reimbursement. Thankfully, State Farm's mobile app and online platform make it easy to add your new vehicle to your policy. Nupur Gambhir is a content editor and licensed life, health, and disability insurance expert. She has extensive experience bringing brands to life and has built award-nominated campaigns for travel and tech. Her insurance expertise has been featured in Bloomberg News, Forbes Advisor, CNET, Fortune, Slate, Real Simple, Lifehacker, The Financial Gym, and the end-of-life planning service.

Hawaii also holds on as the least expensive state for homeowners insurance in the country. Its average rates are an astounding 203% lower than the national average. When you opt for 12-month insurance, your rates are secured for a year. Your insurance rate can increase with a six-month policy, even if you didn't have any car accidents or receive any traffic violations during that time. Most insurers cover someone else driving the policyholder's car with their permission once in a while. But, if you're going to start driving one of your parent's cars regularly, you'll need to be added or named on their auto insurance.

Is $1,680 per year, but shoppers can use a number of strategies to reduce their premiums. Roofing discounts, for customers who use certain impact-resistant products on roof renovations. Prices for goods and services in Frankfurt are partly crowdsourced by our visitors, just like yourself. Use the link below to embed the infographic from our site and automatically keep the data layer up to date. Living cost above is my experience - exactly same as in my town "Lidl, Aldi for food. C&A; H&M for cloth" exact prices.

You can bundle pretty much any State Farm insurance product and save , but the big fish on State Farm’s multiple line discount menu is its auto and home insurance bundle. But, you still may be able to purchase flood insurance if your community participates in the National Flood Insurance Program . In fact, most flood insurance is written through the NFIP, administered by the Federal Emergency Management Agency . It normally takes 30 days from the date of purchase to go into effect.

No comments:

Post a Comment